America’s largest and most prominent companies are now stepping up to reveal their performance over the past three months. So far, the outlook is positive — bank stocks surged right out of the gate, pushing major stock indices higher.

Netflix was the standout story in last week’s earnings roll. The streaming giant drove the S&P 500 to its sixth consecutive week of gains after surpassing Wall Street expectations for both earnings and revenue. It also raised its revenue guidance beyond forecasts.

Netflix solidified its position as the top player in streaming, adding 5.1 million new subscribers across its tiers. The biggest growth came from its ad-supported membership, which saw a 35% year-over-year increase.

The company reported $5.40 in earnings per share, beating analysts’ expectations of $5.12. Profit reached a record $2.4 billion, up 41% from last year. Revenue for the September quarter totaled $9.8 billion, a 15% increase from the previous year and slightly above projections. Shares of the streaming platform are up 62% on the year, valuing the company at more than $300 billion.

Tesla will release its earnings this Wednesday after the market closes. Revenue is expected to rise compared to last year, but profits are expected to shrink slightly.

The big data dump comes just weeks after Tesla’s robotaxi event, which not only failed to excite investors but also wiped billions off the company’s market cap.

The key question now is whether Tesla will deliver a strong earnings report or disappoint investors.

Here’s what traders are expecting: revenue of $25.4 billion, significantly higher than the $23.4 billion from the same quarter last year. Earnings per share of 48 cents, down nearly 10% from 53 cents a year ago. Net income is projected at $1.68 billion, down from last year’s $1.85 billion. Tesla delivered 462,890 cars in the September quarter, narrowly beating mid-range expectations.

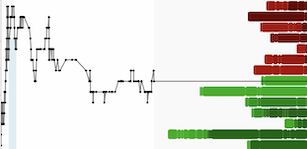

Analysts on Wall Street aren’t exactly aligned on Tesla stock price direction. Tesla’s shares have had a volatile year, dropping 40% at one point, recovering, and now down about 11%, with the current price at $220.70 per share.