Vancouver, British Columbia--(Newsfile Corp. - October 16, 2024) - Thesis Gold Inc. (TSXV: TAU) (WKN: A3EP87) (OTCQX: THSGF) ("Thesis" or the "Company") is pleased to announce the Company has filed on SEDAR+ an updated Preliminary Economic Assessment ("PEA") technical report (the "Report") for its wholly owned Lawyers-Ranch Project located in British Columbia, Canada. This updated PEA supersedes the previously filed Lawyers-only PEA (effective date September 9, 2022).

The Report, entitled "Updated Preliminary Economic Assessment for the Lawyers-Ranch Project and Property" was independently prepared by JDS Energy & Mining Inc. of Vancouver, British Columbia, Canada in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and has an effective date of August 30, 2024.

The updated PEA results support a 12,600 tonnes per day open pit mining operation over a 14-year mine life. Highlights include:

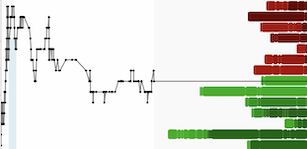

- Strong Economics: Pre-tax internal rate of return ("IRR") of 46.0%, pre-tax net present value at a 5% discount rate ("NPV5%") of C$1.99 billion, after-tax IRR stands at 35.2%, and an after-tax NPV5% of C$1.28 billion, using US$1,930 per ounce of gold and US$24 per ounce of silver (see Table 1).

- Gold Price Sensitivity: The project remains robust at a wide range of gold prices from US$1,750 to US$2,500 with after-tax IRR of 28.8% to 52.8% (see Table 2).

- Increased Production: The 2024 PEA saw a considerable increase in production versus the previous (2022) PEA with a 32% increase in annual average production to 215,000 gold-equivalent ("AuEq"*) ounces, including an average 273,000 gold-equivalent ounces annually over the first three years, and a 55% increase in Life-of-mine ("LOM") production to 3.0 million gold-equivalent ounces, extending mine life to over 14 years.

- Low AISC: LOM all-in sustaining cash cost ("AISC") of US$1,013 per ounce of gold equivalent.

- Quick Payback: The project offers a quick after-tax payback of 2.0 years, a 29% decrease compared to the previous (2022) PEA.

- Capex: Initial capital expenditure is estimated at C$598.4 million, with a compelling after-tax NPV5% to initial capital ratio of 2.1:1.

- Project Upside: Significant Mineral Resource growth potential remains across both Lawyers and Ranch projects. The underground Mineral Resource at Lawyers is still open for expansion at depth, while Ranch Mineral Resource zones also remain open. Additionally, there are over 20 unexplored targets that hold potential for further discoveries.

The PEA and summary above, is preliminary in nature and includes the use of inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable then to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

More details can be found on Thesis' news release announcing the updated PEA dated September 5, 2024.

The PEA is available on SEDAR+ and Thesis' website, www.thesisgold.com.

AuEq* = Au + Ag/87

On behalf of the Board of Directors

Thesis Gold Inc.

"Ewan Webster"

Ewan Webster Ph.D., P.Geo.

President, CEO, and Director

About Thesis Gold Inc.

Thesis Gold Inc. is a resource development company focused on unlocking the potential of its 100% owned Lawyers-Ranch Project, located in British Columbia's prolific Toodoggone Mining District. The recently completed Preliminary Economic Assessment (PEA)[1] highlights robust project economics, including a 35.2% after-tax IRR and an after-tax NPV5% of C$1.28 billion, demonstrating the potential for significant value creation. Over the next 12 months, Thesis is dedicated to advancing the Project through critical development milestones, including the initiation of a Pre-Feasibility Study (PFS) and progressing permitting and environmental work. The Company will also continue to evaluate multiple high-potential exploration targets across the district, aiming to build on the substantial resource growth potential identified in the PEA. Through these strategic moves, Thesis Gold intends to elevate the Ranch-Lawyers Project to the forefront of global precious metals ventures.

[1] Please refer to the Company's Preliminary Economic Assessment titled, "Updated Preliminary Economic Assessment, Lawyers Gold-Silver Project" with an effective date of August 30, 2024 filed under the Company's profile on SEDAR+ at www.sedarplus.ca, which also provides details of the Company's mineral resource estimates.

The scientific and technical content of this news release has been reviewed and approved by Michael Dufresne, M.Sc, P.Geol., P.Geo., and Carly Church, P.Eng., PMP, Qualified Persons as defined by National Instrument 43-101-Standards of Disclosure for Mineral Projects.

For further information or investor relations inquiries, please contact:

Dave Burwell

Vice President Corporate Development

Email: daveb@thesisgold.com

Tel: 403-410-7907

Toll Free: 1-888-221-0915

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward-Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, statements regarding the use of proceeds from the Company's recently completed financings and the future plans or prospects of the Company. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management, are inherently subject to business, market, and economic risks, uncertainties, and contingencies that may cause actual results, performance, or achievements to be materially different from those expressed or implied by forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Other factors which could materially affect such forward-looking information are described in the risk factors in the Company's most recent annual management's discussion and analysis, which is available on the Company's profile on SEDAR+ at www.sedarplus.ca. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/226876